If you are a salaried employee and wants to save income tax by all the possible exemptions provided by the government then you are at the right place. We will talk about all the possible and legal ways to save taxes. We will not talk about saving taxes by any unfair means.

A penny saved is a penny earned

- Don’t hide any income. show everything.

- Use of HRA given by employer. It is the minimum of below three components.

– Actual Rent Paid

– HRA given by employer

– 40% of basic salary - 1.5 Lac under 80C. You can invest in multiple schemes to take the exemptions under 80C.

– PF

– ELSS 3 years locking period

– FD locking period of 5 years

– SSY

– NPS

– PPF - Give donation to political parties. (80 GGC)

- Invest in NPS (80CCD (1B) )

- You can take the help of your spouse or parents in trading and other investments.

- Medical Insurance premium 80D section

- LTA on travel tickets of your parents, spouse, and kids within India.

– Twice in a block of 4 years. eg: 2018-21, 2022-25

– Your unused LTA of last block year can be used only in the first year of next block year.

– You can’t claim two LTA in a single year, but you can divide it between you and your wife.

– If you are getting 10,000 LTA per year and you travel in the second year then you can claim LTA of 20,000 for two years LTA.

– Only domestic travel is allowed. - Standard Deduction of 50,000. Conveyance allowance and medical allowance

- To take benefits of presumptive tax relaxation on free lance income fill ITR 4 form. Read More

- Losses from house property

Net Annual Value(NAV) = Gross Annual Value(Rent) – Property Tax

Loss/Profit = NAV – 30% NAV (maintainance cost) – Home Loan Interest paid on this.

maximum of 2 Lac of loss we can show in the ITR. - Food coupons

- Fuel Reimbursement maximum 1800 per month

- Driver allownaces maximum 900 per month

- Books & Periodicals Allowance

- Home loan interest paid

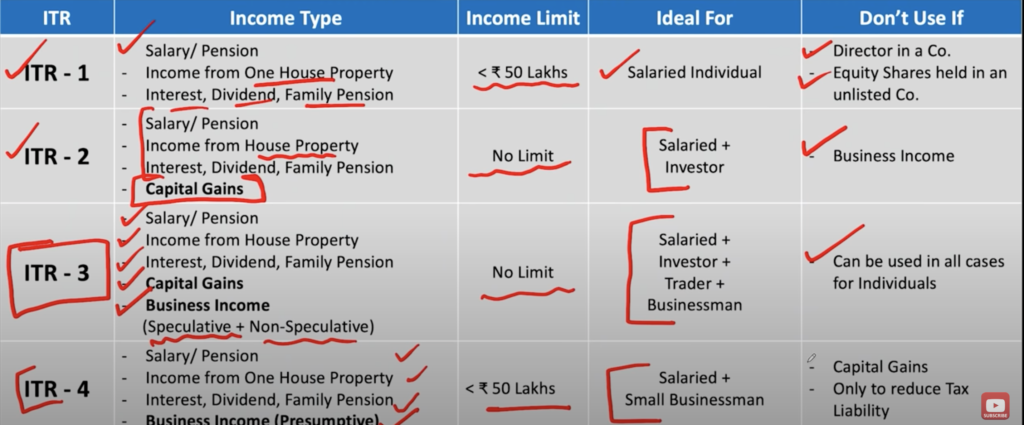

The next question is which ITR form you should fill out, below image will help you to find this answer.

I will keep updating this list based on my knowledge and study. Feel free to write us in the comment section if you have any queries related to this.

Leave a Reply